USA HELPS CONSUMERS INCREASE THEIR RETIREMENT DISPOSABLE NET INCOME BY:

- REDUCING TAXES

- ELIMINATING VOLATILITY

- POSITIONING RESOURCE EARNINGS TO BE GREATER THAN THE RATE OF INFLATION

- PLANNING TO INCREASE SOCIAL SECURITY RETIREMENT INCOME.

YOUR SOCIAL SECURITY DECISION IS ONE OF THE MOST

IMPORTANT DECISIONS YOU WILL EVER MAKE!

EXAMPLE: SOCIAL SECURITY RETIREES

Age to Begin Social Security Benefits:

If started at age 62: If started at age 67:

$1000/month = $12,000 / year = $1500 / month = $18,000 / year =

$180,000 in 15 years (Age 77) $180,000 in 10 years (Age 77)

NOTE: The 67 years-old person (FRA) will receive $6000 / year more for life than the person who began Social Security benefits at 62

years of age.

Social Security Retirement Estimator

Social Security Maximization (VIDEO)

RETIREMENT SERVICES OFFERED BY USA

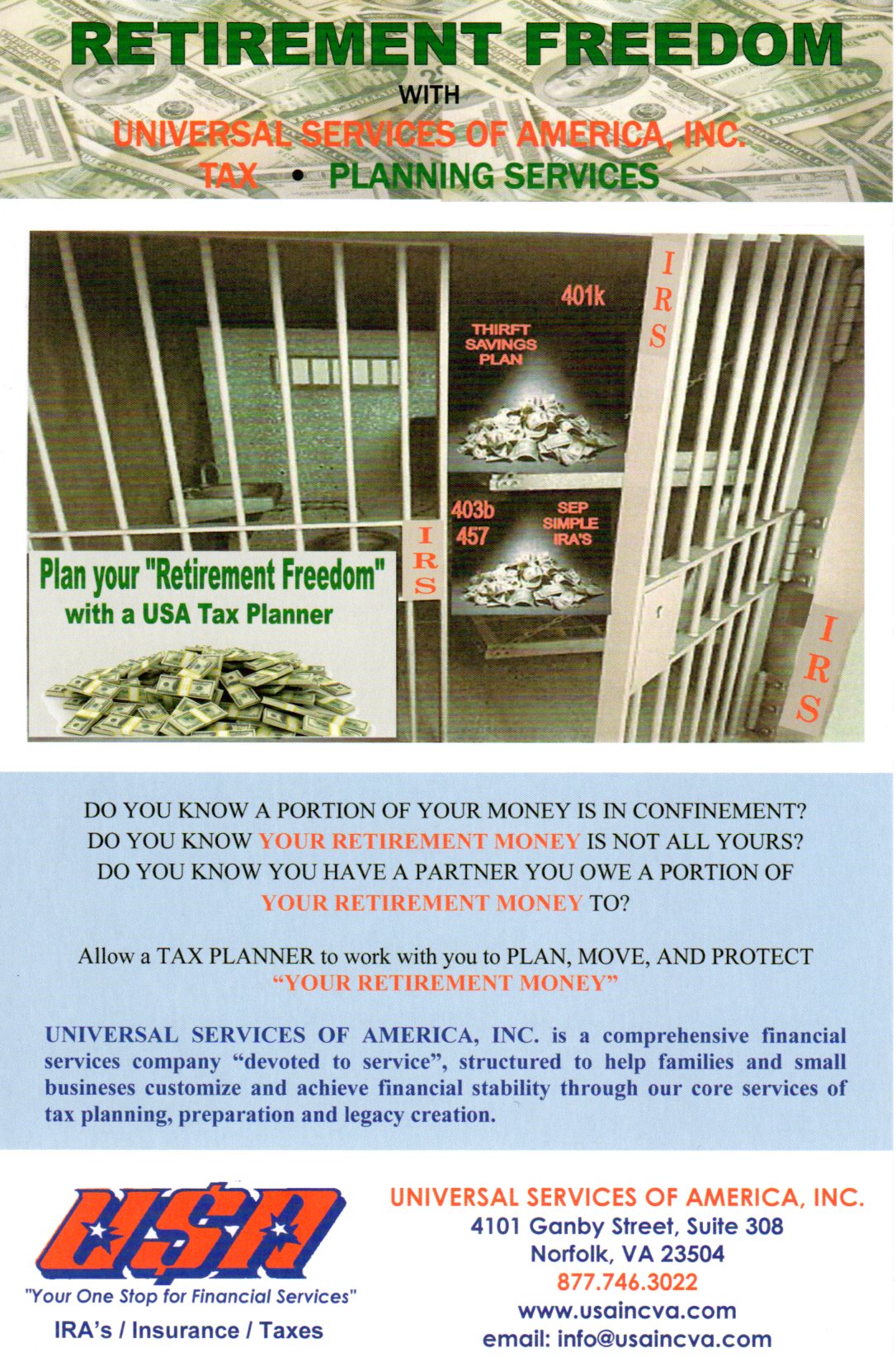

Traditional IRA's, Roth IRA's, 401k, 403b, 457, Thrift Saving Plans and rollover options

Retirement needs and income estimations

Pension Maximization Analysis

Retirement Chronicling

Roth Conversions

SINKING FUND?

WHAT HAVE YOU DONE TO HEDGE YOUR RISKS WHEN YOU DECIDE TO RETIRE?

THE OUTCOME IS THE INCOME. IT'S NOT JUST ABOUT ACCUMULATION. THE OUTCOME OF YOUR SUCCESS WILL DEPEND ON THE INCOME YOU RECEIVE IN RETIREMENT.

CONSUMERS' RISK IS NOT DYING; THAT'S A GUARANTEE.

CONSUMERS' RISKS ARE FOUR-FOLD IN RETIREMENT:

1. VOLATILITY 2. OUTLIVING YOUR MONEY 3. TAXES 4. INFLATION